The following is an overview of the steps involved in setting up the Alternate Tax Interface to CCH® Sales Tax Online. For further detail, contact your STORIS representative.

Alternate Tax Interface field must be set to Active in the General System Control Settings. Contact STORIS.

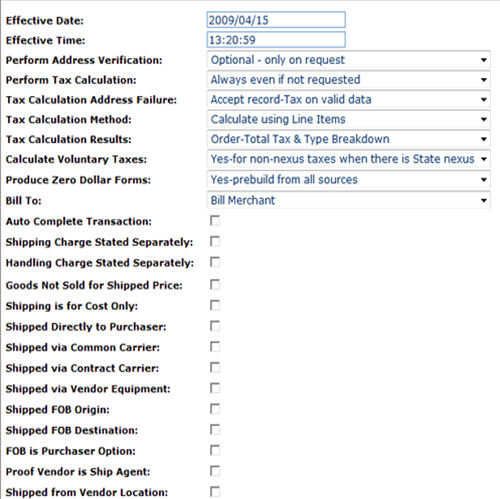

Alternate Tax Interface Control Settings (General and CCH tabs) must be established.

The effective date of a transaction cannot be prior to your live date with CCH. Your live date is entered in the CCH Enrollment Date field of the Alternate Tax Interface Control Settings.

Product taxable status is maintained in CCH and used in online processing, but can be maintained in STORIS for offline processing of take with and customer pickup orders.

Set up your non-taxable items on the CCH system with a product category of Non-Taxable.

![]() In order to have the ability to process take-with

and customer pickup orders offline, you need to maintain product taxable

status settings in STORIS, in addition to the settings in CCH.

In order to have the ability to process take-with

and customer pickup orders offline, you need to maintain product taxable

status settings in STORIS, in addition to the settings in CCH.

Business Rules need to be set up on the CCH system as follows. Other than the Effective Date and Time shown here, these are the values you should enter in CCH in order to use the STORIS Alternate Tax Interface.

CCH Sales Tax Online Business Rules

CCH Sales Tax Office Business Rules

Business Rule |

Options |

Enforce strong validation |

· Yes · No |

Process tax on tax where applicable |

· Yes · No |

Processing option if Customer ID is not valid |

· Accept the transaction · Reject the transaction |

Processing options if Group/Item or SKU/Category is not valid |

· Error · Use Default Group and Item for Division |

Use Custom Data |

· Yes · Do not use custom data for transaction calculations |

Use Overrides |

· Yes · Do not use overrides for transaction calculations |

Use situs decision for transaction processing |

· Yes · No |

![]() While not a business

rule, a configuration setting exists to report line-item tax as 2 decimal

places instead of 3. This setting must be set to use 2 decimal places

and must be communicated to clients using this interface.

While not a business

rule, a configuration setting exists to report line-item tax as 2 decimal

places instead of 3. This setting must be set to use 2 decimal places

and must be communicated to clients using this interface.

Set up locations and SKU numbers on the CCH system prior to utilizing the interface.

Items not set up on the CCH system default to a product category of 'General Merchandise'. Items set with the product category of ‘General Merchandise’ are taxable.

You must set up SKU numbers for delivery, installation and restocking charges on both the CCH and STORIS systems.

When setting up the SKU number for delivery charges in CCH, the product category must be set to one of the FRGHT settings. This setting determines, by state, whether or not delivery charges are taxed.

You can define the CCH product category for installation and restocking charges.

Once the SKUs for delivery, installation, and restocking charges are established, you need to enter these SKUs on the CCH tab of Alternate Tax Interface Control Settings in STORIS.

Delivery, installation, and restocking charges are sent to CCH as line items. The SKUs defined in the Alternate Tax Interface Control Settings are used for these charges.

Tax is only calculated on delivery charges if there are taxable line items included in the transaction, according to CCH’s ‘Freight Follow Rule ’.

Use Update Alternate Tax Interface Data to update tax jurisdictions for the locations specified. Rates are calculated and stored in the sales tax records and used for offline processing.

Report Sales Tax - shows names of tax jurisdictions (example: NJ = New Jersey) and the Transaction ID (can reference in CCH lookups)